Personal Insurance Policies

Free Quotes | Over 30 Years of Experience | Locations in FL and PA

Free QuotesOver 30 Years of ExperienceLocations in FL and PA

Personal Insurance Lines for Cars, Homes, and More

RTI Insurance Services covers all your personal insurance needs. Our team of representatives compare polices from the top providers to help you assemble a package that meets your needs at a price that's right.

To request a free quote, please call us or use our convenient

online form. When you fill out our form to request a quote on a personal line, please be sure to include your address.

Homeowner's Coverage

The biggest investment most people will ever make is in their home. That’s why it makes sense to protect the sizable financial investment you’ve made in your home with a comprehensive homeowner's plan. Your home purchase is an investment that deserves the protection that only an experienced insurance professional can provide.

Basic Protection

- Home

- Other buildings or structures on your property

- Your personal belongings (furniture, clothing, appliances, etc.)

- Additional living expenses

- Your personal legal liability

Additional Coverage

- Replacement cost on contents

- Additional Coverage Form

Personal Auto Coverage

If you have any doubts about the level of automobile coverage that's right for you, know that we have excellent plans available through reputable auto insurers. We will be happy to help pinpoint the coverages best suited to your needs.

Auto Insurance Services Available

- Bodily injury to others

- Personal injury protection

- Bodily injury caused by uninsured auto

- Damage to someone else's property

- Optional coverages

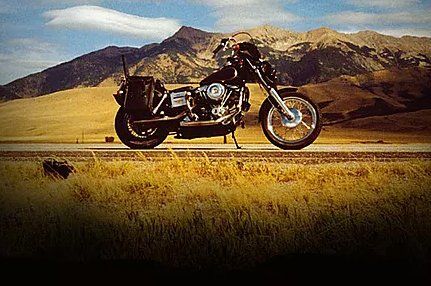

Motorcycle Coverage

Protection for riding is more than just a helmet and a jacket. You need to insure yourself and your motorcycle from all the dangers that you face on the road, including accidents, theft, injury, etc.

Whether you’re a new rider or you’ve been riding for 20 years, cover yourself with one of our comprehensive motorcycle plans before you hit the open road.

Motorcycle Coverages

- Property damage liability

- Bodily injury liability

- Uninsured/underinsured motorist coverage

- Custom parts and equipment (CPE)

- Roadside assistance

- Passenger liability coverage

- Comprehensive collision coverage

- Medical payments

Watercraft and Yacht Coverage

Whether you’re dry docked or enjoying life on the high seas, make sure you’re covered by one of our comprehensive Boat Insurance Plans. Accidents do happen. If you are personally injured or if your boat sinks, capsizes, or is damaged by a storm, your policy will protect you. Find out today how we can cover your investment and save you money.

Types of Watercraft Insured

- Boats — vessels between 16 ft. and 26 ft. long

- Yachts — vessels over 26 ft.

- Personal watercraft — under 16 ft. (Jet Skis, WaveRunners, etc.)

Watercraft Coverages Available

- Boat liability

- Medical payments

- On-water towing

- Property damage

- Uninsured/underinsured watercraft

- Consequential damage coverage

- Salvage coverage

- Trailer

Share On: